Reading Your Fingerhut Statement.

Other Credit Education topics:

Credit 101 |

Fingerhut Credit

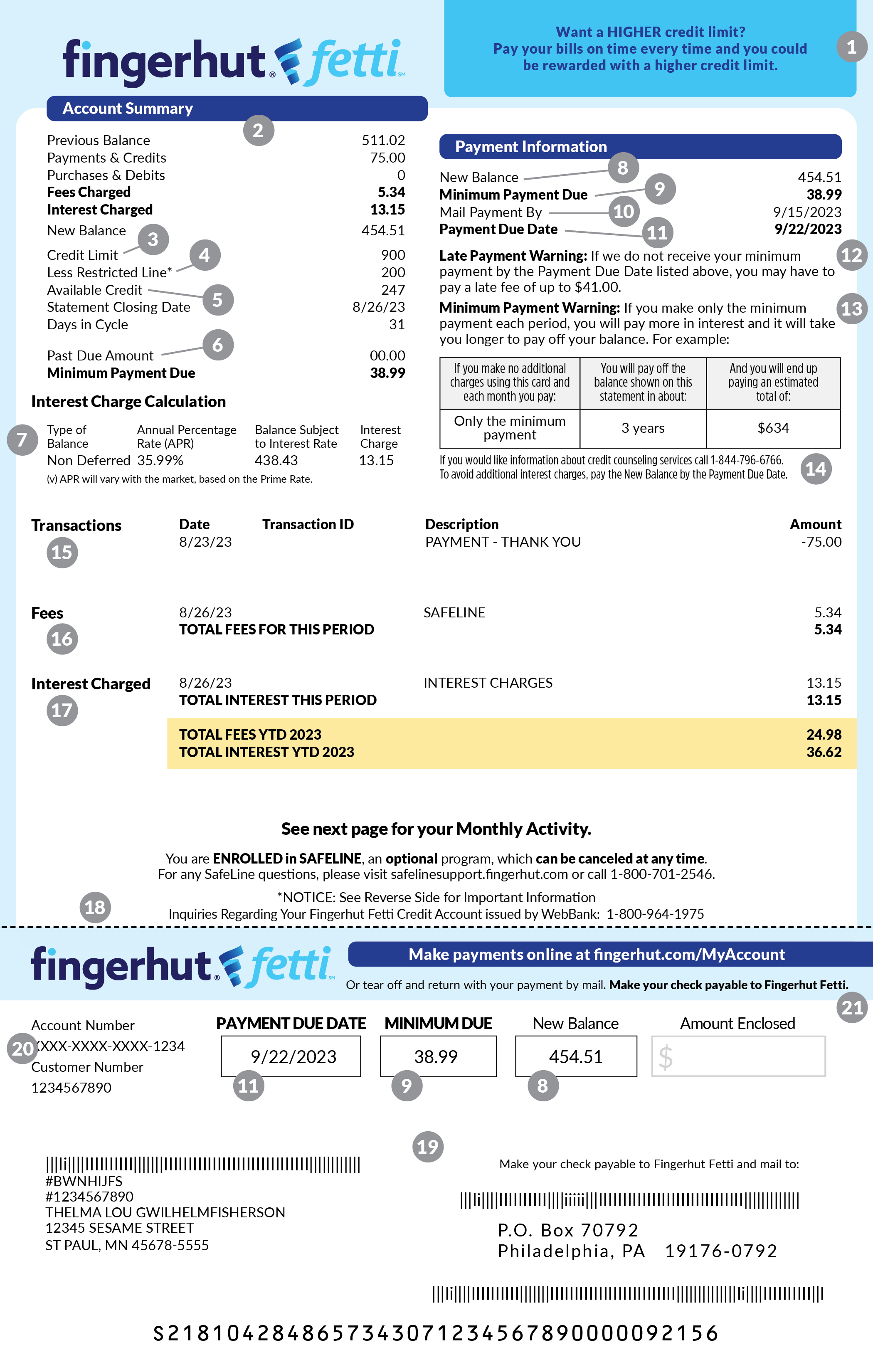

Your monthly Fingerhut Fetti statement provides you with lots of helpful information about your account. It's a good idea to review your statement as soon as it arrives. Be sure to check the Minimum Payment Due and the Mail Payment By date. You need to know these to keep your account in good standing.

The diagram below shows where you'll find the information on your statement.

1. Important Messages

Learn about the latest offers, credit tips and important information.

Learn about the latest offers, credit tips and important information.

2. Your Account Activity Summary

Your newest balance, previous balance, payments, credits, new purchases and interest charges are here.

Your newest balance, previous balance, payments, credits, new purchases and interest charges are here.

3. Credit Limit

The maximum amount you can charge to your account.

The maximum amount you can charge to your account.

4. Restricted Credit Line

A restricted line is when a portion of your available credit is not currently available to make purchases. If you previously had a Fingerhut Advantage Credit Account it is based on your Fingerhut Advantage credit account and other credit factors

A restricted line is when a portion of your available credit is not currently available to make purchases. If you previously had a Fingerhut Advantage Credit Account it is based on your Fingerhut Advantage credit account and other credit factors

5. Available Credit

This is the amount available to you for purchases. This amount is your charges subtracted from your credit limit.

This is the amount available to you for purchases. This amount is your charges subtracted from your credit limit.

6. Past Due Amount

The amount you owe that is past due. Most often this means you have missed a payment or have not paid the minimum amount due.

The amount you owe that is past due. Most often this means you have missed a payment or have not paid the minimum amount due.

7. Interest Charge Calculation

Lists any interest charges and all applicable rates for both non-deferred and deferred purchases.

Lists any interest charges and all applicable rates for both non-deferred and deferred purchases.

8. New Balance

The total amount you owe. This includes any unpaid balances from previous months, new purchases, late fees and interest charges.

The total amount you owe. This includes any unpaid balances from previous months, new purchases, late fees and interest charges.

9. Minimum Payment Due

The minimum amount you must pay each month. If you pay more than the minimum, you will pay off your balance more quickly with less interest charges.

The minimum amount you must pay each month. If you pay more than the minimum, you will pay off your balance more quickly with less interest charges.

10. Mail Payment By

Mail your payment by this date to avoid late fees.

Mail your payment by this date to avoid late fees.

11. Payment Due Date

The day your payment is due at Fingerhut. If your payment is received after this date, a late fee may be charged. If you're running late, you can always pay your bill online to prevent late fees!

The day your payment is due at Fingerhut. If your payment is received after this date, a late fee may be charged. If you're running late, you can always pay your bill online to prevent late fees!

12. Late Payment Warning

A reminder about the late fee you may be charged if your payment is not received by the Payment Due Date.

A reminder about the late fee you may be charged if your payment is not received by the Payment Due Date.

13. Minimum Payment Warning

This is the length of time to pay off your current balance if you only make the required minimum payments by the Payment Due Date. It's to your benefit to pay more than the minimum amount due each month. However, by paying your New Balance in full, you will avoid paying any additional interest charges.

This is the length of time to pay off your current balance if you only make the required minimum payments by the Payment Due Date. It's to your benefit to pay more than the minimum amount due each month. However, by paying your New Balance in full, you will avoid paying any additional interest charges.

14. Credit Counseling

Call the toll-free number listed for helpful information about managing credit.

Call the toll-free number listed for helpful information about managing credit.

15. Transactions

A list of your new purchases and payments made since your last statement.

A list of your new purchases and payments made since your last statement.

16. Fees

Lists any fees and reasons you were charged during the billing period. Fees charged year to date are also provided.

Lists any fees and reasons you were charged during the billing period. Fees charged year to date are also provided.

17. Interest Charged

See the exact amount of interest charged during this billing period. Interest charged year to date is also provided.

See the exact amount of interest charged during this billing period. Interest charged year to date is also provided.

18. How to Contact Us

Find phone numbers and ways to contact us regarding your account.

Find phone numbers and ways to contact us regarding your account.

19. Statement Coupon

Return this portion with your payment check, made payable to Fingerhut Fetti. This portion also includes account balance, minimum payment due and mail payment by date.

Return this portion with your payment check, made payable to Fingerhut Fetti. This portion also includes account balance, minimum payment due and mail payment by date.

20. For Your Protection

For your protection, we don't print your full 16-digit account number here. If you use your bank's bill pay service, please use all 16 numbers. Do not use an "X" in your account number, as it will delay payment to your account, and you may be charged a late payment fee.

For your protection, we don't print your full 16-digit account number here. If you use your bank's bill pay service, please use all 16 numbers. Do not use an "X" in your account number, as it will delay payment to your account, and you may be charged a late payment fee.

22. Don't use checks?

Pay your bill at fingerhut.com/MyAccount. While you're there, sign up for e-statements to help reduce mail. It's easier on you and the environment.

Pay your bill at fingerhut.com/MyAccount. While you're there, sign up for e-statements to help reduce mail. It's easier on you and the environment.